1. Good credibility

Since we obtained our Securities Market Credit Rating Business License, we have engaged actively in the credit rating business in the securities market by leveraging the “Lianhe” (“United”) brand name and applying our principle of independence, objectiveness, fairness and consistency. After years of practice, we have developed a systematic rating methodology, a ratings business management system, and a well-defined business process. We take strict measures to avoid conflict of interest and isolate risks to ensure the quality of our ratings reports and the independence, impartiality and fairness of our rating outcomes. As a result, we have established ourselves as a reliable, laudable credit rating agency for securities market participants and one of the preferred credit rating agencies for bond issuers and investors.

2. Professional, efficient services

-

Confidentiality: A stringent document management and confidentiality regime has been put in place to ensure confidentiality. And every agreement with issuers contains specific non-disclosure clauses.

-

Scheduling: Each rating project is completed within the time-limit stipulated by regulatory requirements and the relevant agreement.

-

Quality assurance: We have a strict quality control system to ensure that each report issuing from United Ratings is of high quality.

-

Follow-up work: Follow-up ratings after the issuance of a bond are reasonably arranged and disclosed in time to interested parties.

3. Proven expertise

After over a decade of credit rating business in the lending and capital markets for over a decade, United Ratings has amassed a wealth of experience and established a wide range of rating measures for several dozens of market segments, including new energy, the Internet, technology and other emerging industries as well as more traditional sectors such as natural resources, manufacturing, trading and financial entities.

In dealing with asset securitization, United Ratings employs a slew of talented people specializing in quantitative analysis and risk modeling, who have helped develop and improve a rating system for bank credit asset securitization, including CLOs, RMBS/CMBS, auto loans and credit cards and other consumer loans. In addition, a rating methodology and a cash flow stress test model have been established for roads & bridges, utilities, airports, leased assets, tourist ticket income, accounts receivable and other business asset securitization projects. United Ratings also assessed a number of innovative asset securitization projects.

4. Innovative projects

-

The first publicly offered renewable corporate bond – Zhejiang Communications Investment Group’s renewable bond, 2016.

-

The first online consumer debt-backed securitization – JD’s IOU receivables-backed project.

-

The first stock-pledged debt-backed project – CITIC Huaxia stock-pledged securitization (I).

-

The first business receivables-backed project – Sinolink-Jinguang asset-backed securitization (I).

-

The first cinema revenue-backed securitization– Stellar International Cineplex trust beneficiary’s rights-backed project.

-

The first affordable housing-backed securitization – Xuzhou affordable housing asset management plan.

-

The first air-ticket income-backed securitization – Hainan Airlines BSP income-backed project.

-

The first ticket income asset management plan – Happy Valley Theme Park ticket income asset management plan.

-

The first personal consumption debt-backed securitization – Ping An Bank No. 1 small consumer loans-backed securities.

5. A high degree of customer recognition

Since 2008, United Ratings has rated over a thousand publicly offered bonds, and other privately placed bonds, asset-backed securities, trust products, and debt investment plans. United Ratings was highly recognized by issuers and underwriters alike for its quality work in many publicly offered corporate bonds, such as Sinopec’s 60 billion-yuan corporate bond (III) and 23 billion-yuan convertible bond, China Railway Engineering Corp.’s 12 billion-yuan corporate bond, Chongqing Guoxin Holdings’ 9 billion-yuan corporate bond, China Overseas Land & Investment Ltd.’s 8 billion-yuan corporate bond, Sunac’s 6 billion-yuan corporate bond, and Guosen’s 26 billion-yuan subordinate bond. Ratings of these bonds were also well received by investors as they were satisfied with the issued interest rates.

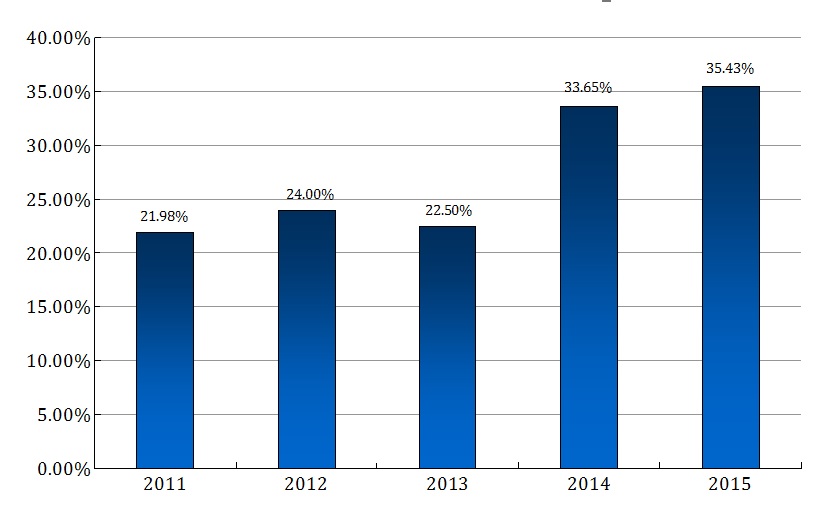

By the number of bond issues, United Ratings possessed leading market shares in the field of corporate bond rating in recent years.

United Ratings’s Market Shares in Publicly Offered Corporate Bonds in Recent Years